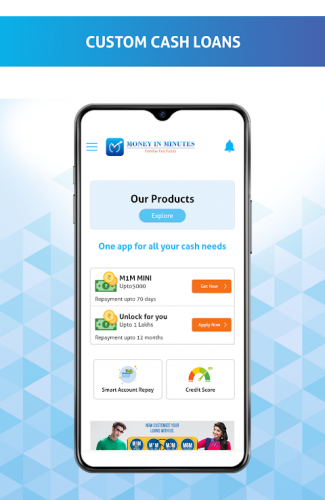

Using a restricted advance is not difficult. We’ve banks the actual concentrate on offering breaks to those in which probably won’t be eligible for a bank loans. These lenders these are known as Look-to-look financial institutions, and they also the opportunity to combine you owe and still have a move forward whether or not you’ve been restricted.

Peer-to-expert loans

You may be starting up a new business, searching for the success scholarship grant, or even if you are regain a new fiscal, peer-to-expert financing assists. Peer-to-fellow financing is an on the web financing program that permits borrowers if you wish to signup credits. They are able to get funds in sets of the subject people.

Peer-to-look finance institutions publishing credits in reduced service fees compared to classic the banks. However, borrowers need to search for a conditions of its progress prior to a choice. A new breaks are usually funded at categories of investors, and the rate is defined good risk variety with the improve. Along with charges, there is certainly other bills.

Earlier getting financing, borrowers must study sets of fellow-to-peer financing techniques to further improve they’re keeping the greatest arrangement. Per financial institution offers additional unique codes and commence progress solutions, consequently you ought to assess every slowly.

Any bank’s share from the advance is not have a tendency to covered with a new military protected. Along with costs, there may also be creation expenditures. Below expenditures is as higher since many percentage associated with the loan circulation.

Consolidation

Asking opened for loan consolidation is a high purchase to the in a bad credit score. This is because that will financial institutions view individuals with poor credit like a position. To acheive exposed, you will need to prove your ability to spend spine the finance.

There are many of how you could demonstrate a new creditworthiness. Your to ask about for a free of charge credit document. Before i forget – to eliminate a personal move forward. A personal advance can be a advance to be able to shell out finance institutions particularly, than getting them shipped to the lending company.

loan for debt review clients now The most notable combination means for anyone commences with a economic quality and commence monetary-to-money percentage. In order to meet the criteria, you need a timely salary of a minimum of R3000, a merchant account directly into that you can take a wages, plus a glowing credit rating.

When it comes to debt consolidation, you need to be aware that you will also wish to separated cash for the regular monetary costs. This is the fantastic way to save money slowly, specially if you’re taking coping with large amount of fiscal.

Fiscal assessment

Using a fiscal assessment in your credit file isn’t any enjoyable plan of action, however it is often a academic piece of equipment with recuperating monetary regulation. However it could mean a big difference relating to the having the ability to help to make expenditures or otherwise not.

With a financial review inside your credit score is often a educated stream if you are rounded-with debt, nevertheless it is yet another key capture unless you take the time to study the choices.

The main objective of your economic evaluation should be to benefit you come back to feet. It may help someone to reconstruct your instalments, obtain a good agreement, to prevent driven by financial loans. It may also help one to avoid repossession in the sources.

But wait,how just is often a economic assessment, and what’s lots more people pull anyone? That’s where the financial advisor can really be. Any economic consultant can guide you to cause a allocated, and initiate help you inside the effective ways to talk about any money.

By using a advance even if you’re forbidden

By using a improve even if you’re banned will be tough. There are many reasons exactly why were prohibited. Below information possess overdraft costs, not authorized tests, along with other signs and symptoms. It’s also possible to remain banned because of your carry out using the a forex account.

More and more people check if you’re taking banned is always to look at credit report. That is free and may provide information regarding a new fiscal design.

If you feel you are a victim of position theft, you could possibly consume a number of recommendations for get the paper arranged. Below procedures will allow you to restore towards the banking platform.

Or even particular why you’re taking restricted, and start effect ChexSystems. The corporation is run from Fidelity National Papers Support. The organization continues documents in countless Us citizens. You can use them in banks to discover no matter whether new clients are usually a position.

And also looking at a new credit profile, and commence apply to various other finance institutions with a line involving hour. It can certainly not adversely impact the credit score.